Work in progress!

An earlier version of this paper can be downloaded here as a pdf.

Blockchain

The purpose of this paper is to give a quick introduction into the field of blockchain.

Fundamentals

Blockchain is the first immutable database technology invented in 2008 [1]. A blockchain database is resistant to modification by design.

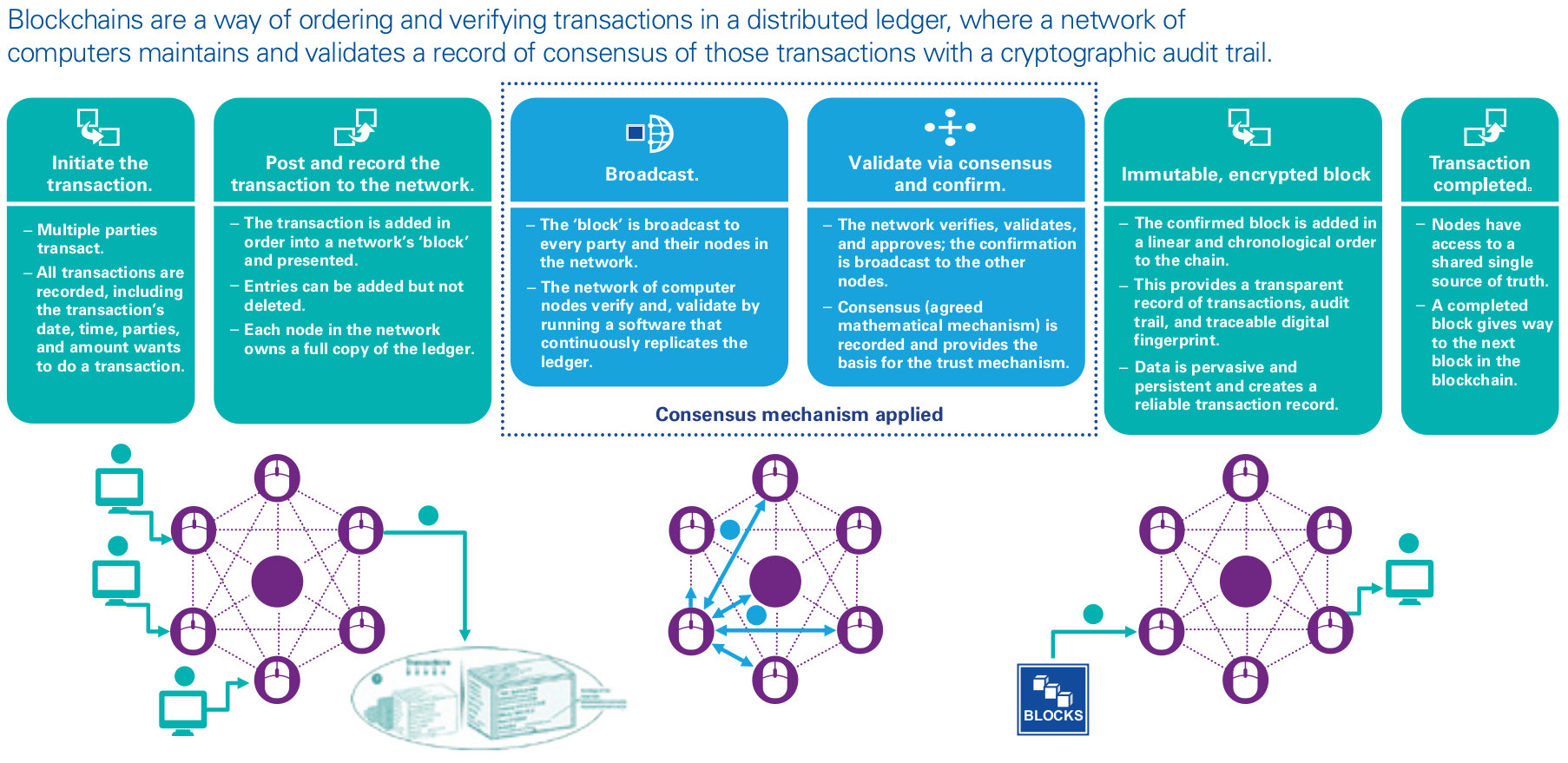

Blockchain is a distributed ledger that can record transactions between parties in a verifiable and permanent way. Transactions are irreversible (unlike in the traditional financial system). One revolutionary consequence of this is that businesses need not keep separate ledgers of transactions, but can use a common database that no one controls. Neither trust between participants nor external authority/regulator is required. Huge savings result because of the high costs of resolving discrepancies between separate ledgers.

A blockchain system works by each participating computer (node) running software which adheres to the same protocol for inter-node communication and validating new blocks of data. Thus, blockchain is typically managed by a peer-to-peer network, hence it is decentralized. One key benefit of this is no single point of failure.

Data is added to the blockchain database as a time-stamped sequence (chain) of standardized blocks. The blocks of transactions are stacked on top of each other indefinitely. Once recorded, the data in any given block cannot be altered retroactively without alteration of all subsequent blocks, which requires consensus of the network majority.

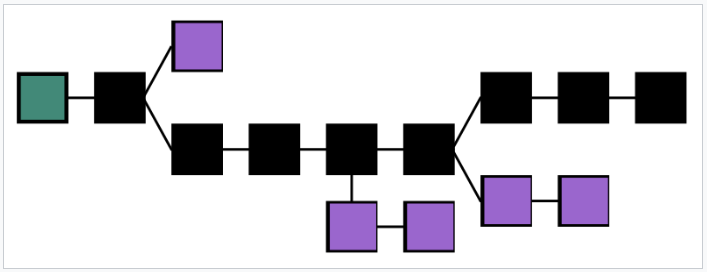

Figure: Blockchain formation.

Main chain (black) consists of the longest series of blocks

from the

genesis block (green) to the current block.

Orphan blocks (purple) exist outside of the main chain.

Since each block is timestamped, blockchain can serve a timestamping function:

If you record something into an immutable blockchain at a certain point in time, then at any future moment you have a proof that this information actually existed back then.

A blockchain system works by each participating computer (node) running software which adheres to the same protocol for inter-node communication and validating new blocks of data. Thus, blockchain is typically managed by a peer-to-peer network, hence it is decentralized. One key benefit of this is no single point of failure.

A wide variety of blockchain designs exists.

Examples of architectural differences between blockchains include:

- • Public / private / semi-private blockchains (permissioning).

- • Consensus mechanisms: Proof-of-work, proof-of-stake, delegated, federated, etc.

- • Inter-block time (e.g., 10 min for Bitcoin, 15 sec for Ethereum, 0.4 sec for Solana).

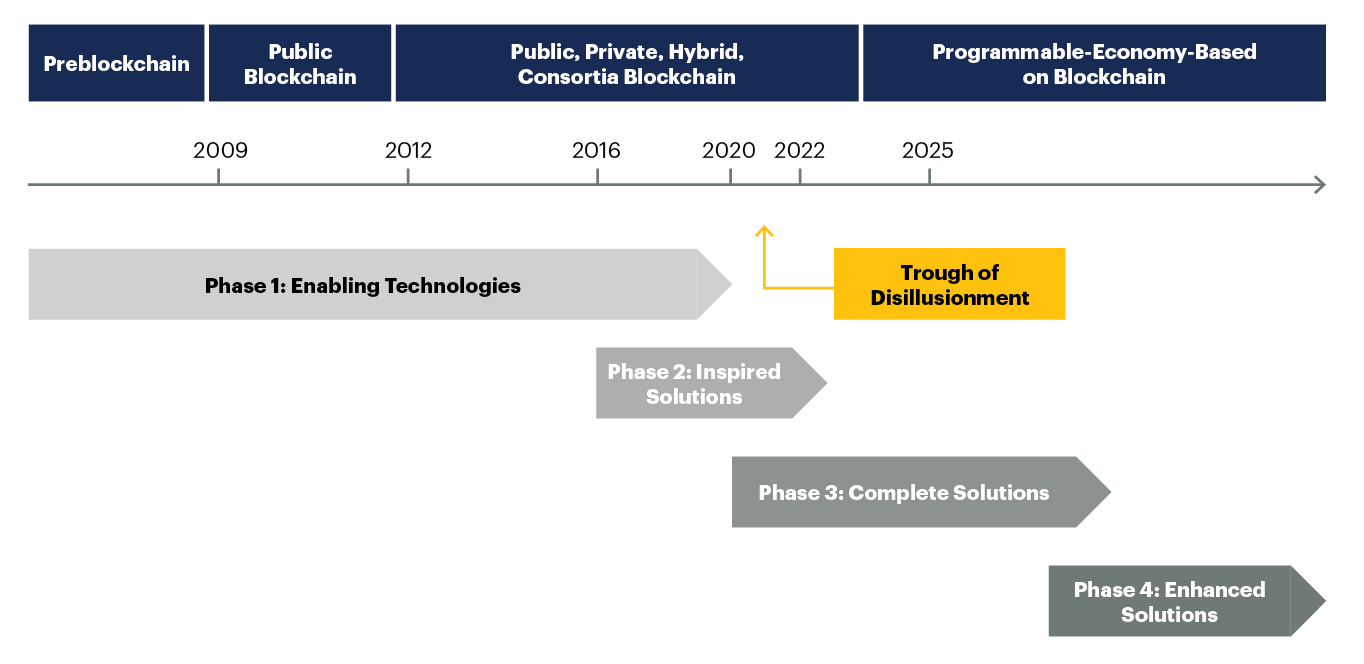

Blockchain Timeline

Requirements to blockchain systems that serve enterprise-scale or planet-scale needs are similar to those typically seen in "big data" distributed databases:

• throughput ~1 million tps (transactions per second)

• capacity >1 Petabyte

• latency <1 second.

For comparison:

Stock exchanges and ad networks run 100k-500k tps.

Visa handles 2k tps on average, with a peak rate of 56k tps.

For scalability, blockchain must have high thruput, high capacity, and low latency.

Consensus mechanism - a method to authenticate and validate a transaction without the need to trust a centralized authority. Can be constructed on and off a blockchain. A variety of approaches exist.

Authentication - proving counterparty identities and existence of assets via cryptographic private/public keys.

Cryptocurrencies

Among the many blockchain applications, money (cryptocurrencies) is notable for its impact and robustness. Bitcoin was the first and is still the dominant implementation. Thousands of cryptocurrencies exist with various purposes, use cases, and target audiences.

• Cryptocurrency is 2-in-1: Money + Payment System• It operates 24/7.

• It is global, borderless, and jurisdiction-agnostic.

• Its design can be permissionless - anyone can use such cryptocurrency with full rights equal to those of any other entity's.

• Cryptocurrencies are referred to as "cash for the Internet".

What the internet has done for information exchange - irrelevance of national borders, fast, near-costless communication - cryptocurrencies have done for payments.

Transaction irreversibility in cryptocurrencies makes it practical to use micropayments (fractions of a penny). These can be useful in a variety of applications, e.g. for online or mobile billing per usage in tiny amounts. The traditional financial system cannot handle micropayments because the cost of dispute resolution makes them uneconomical. Traditional financial transactions are always reversible, except cash.

Smart Contracts

Another groundbreaking impact of the blockchain technology is that it serves as a foundation for creating smart contracts and decentralized applications - autonomous computer programs which operate without human intervention and are not owned by any one entity. These will completely redesign the internet to its next phase called the decentralized web (aka web 3.0).

A blockchain system can be viewed as a distributed computer. The computer code executed on the network makes it possible to form agreements via the blockchain. Such agreements are called smart contracts. They are self-executing, typically with automatic payments. Execution of a smart contract cannot be stopped or altered by any authority.

Smart Property

Smart contracts enable smart property - the property that is controlled, traded, loaned via blockchain using smart contracts. It can be physical (car, house, phone) or non-physical (shares in a company, access rights to a remote computer, etc.)

Making property smart allows it to be traded with significantly less trust. This reduces fraud, mediation fees and allows trades to take place that otherwise would have never happened. For example, it allows strangers to loan you money over the internet taking your smart property as collateral. This makes lending more competitive and thus credit cheaper.

Primitive forms of smart property are already common. For example, cars come with immobilizers, which augment the physical key with a cryptographic protocol, ensuring that only the holders of the correct token (private key) can activate the engine. They have dramatically reduced car theft.

Nowadays, a cryptographic private key is usually held in a physical container (e.g., SIM card) and cannot be easily transferred or manipulated. Smart property changes this, allowing ownership to be intermediated by blockchain miners.

Tokenization is pairing a unique physical item with a corresponding digital token. Physical objects thus can have a digital twin or representation, which can change ownership, etc. Tokens are used in many areas, e.g. supply chain management, intellectual property, anti-counterfeiting, etc.

Distributed markets is a peer-to-peer implementation for securities trading (bonds, stocks, etc.) It relies heavily on smart contracts.

An agent is an autonomous computer program that maintains its own wallet. Agent buys any resources it needs, e.g. server time. It can potentially even hire humans. Money is obtained by the agent selling services. If demand exceeds supply, agents can spawn children that either survive or die depending on whether they can get enough business.

Comprehending the Field of Blockchain

To understand the blockchain field, it can be dissected using several approaches, each targeting different aspects of the technology, its applications, and ecosystem:

1. Technology Stack Approach

Layer 1 (Base Layer): Focus on blockchain protocols like Bitcoin, Ethereum, Solana, etc., that form the foundational network.

Layer 2 (Scaling Solutions): Analyze scaling solutions like Lightning Network, Optimism, zkSync, which build on top of Layer 1 to improve performance.

Protocols and Standards: Look at consensus mechanisms (Proof of Work, Proof of Stake), cryptographic protocols, and token standards (ERC-20, ERC-721).

Interoperability: Examine cross-chain solutions like Polkadot, Cosmos, and bridges that enable interaction between different blockchains.

2. Use Case & Application Approach

Cryptocurrencies: Study various digital currencies, their purpose, and market dynamics.

Smart Contracts and DApps: Explore decentralized applications, how they work, and their use cases in areas like finance, gaming, and supply chain.

DeFi (Decentralized Finance): Analyze financial services built on blockchain, including lending, borrowing, trading, and yield farming.

NFTs (Non-Fungible Tokens): Understand the unique digital assets, their creation, and their impact on industries like art, gaming, and entertainment.

Enterprise Applications: Focus on how industries like finance, healthcare, and logistics use blockchain for real-world applications (e.g., IBM's Hyperledger, supply chain tracking).

3. Economic and Market Approach

Tokenomics: Study the economics of blockchain tokens, including supply mechanisms, incentives, and governance models.

Market Dynamics: Analyze trends in cryptocurrency markets, trading volumes, and market capitalizations.

Regulation and Compliance: Understand the evolving regulatory landscape, legal challenges, and compliance requirements in different jurisdictions.

4. Development & Community Approach

Development Ecosystems: Investigate tools, programming languages (Solidity, Rust), and platforms used in blockchain development.

Open Source Contributions: Look at the role of open-source communities, GitHub repositories, and the contribution models.

Governance Models: Examine decentralized governance mechanisms, DAOs (Decentralized Autonomous Organizations), and voting protocols.

5. Security & Privacy Approach

Cryptographic Security: Study how cryptographic techniques secure blockchain data, including hashing, digital signatures, and encryption.

Attack Vectors: Analyze potential vulnerabilities like 51% attacks, Sybil attacks, smart contract bugs, and how they are mitigated.

Privacy Solutions: Look at privacy-focused projects (e.g., Monero, Zcash) and technologies like zk-SNARKs, confidential transactions.

6. Interdisciplinary Approach

Economics and Game Theory: Apply economic principles and game theory to understand incentives, network effects, and consensus mechanisms.

Law and Ethics: Explore legal frameworks, ethical considerations, and the societal impact of blockchain technology.

Sociological Impact: Investigate how blockchain affects communities, power dynamics, and societal structures (e.g., decentralized governance, inclusion).

7. Historical and Evolutionary Approach

Timeline of Development: Trace the history of blockchain from Bitcoin’s inception to the present, highlighting key milestones and technological advancements.

Evolution of Use Cases: Analyze how blockchain applications have evolved from simple cryptocurrencies to complex DeFi systems, NFTs, and enterprise solutions.

8. Comparative Approach

Blockchain vs. Traditional Systems: Compare blockchain-based solutions with traditional centralized systems in areas like finance, identity management, and data storage.

Cross-Blockchain Comparisons: Compare different blockchains (e.g., Ethereum vs. Solana) based on performance, security, scalability, and use cases.

1. Fundamental Concepts:

DLT: Core concept of a distributed ledger, its benefits over traditional databases, and how consensus mechanisms ensure data integrity.

Cryptography: Grasp the fundamental cryptographic algorithms (hashing, encryption, digital signatures) that underpin blockchain security.

Smart Contracts: Learn about programmable contracts executed on the blockchain, their benefits, and potential limitations.

2. Applications and Use Cases:

Financial Services: applications like cryptocurrency, remittances, and supply chain finance.

Healthcare: Learn about electronic health records, medical research, and clinical trials on the blockchain.

IoT: Understand how blockchain can secure and manage data generated by IoT devices.

Supply Chain: Explore blockchain's role in tracking and verifying the provenance of goods.

3. Technical Aspects:

Consensus Algorithms

Scalability: Understand the challenges of scaling blockchain networks and explore solutions like sharding and sidechains.

Interoperability: Learn about the efforts to connect different blockchain networks and enable seamless data exchange.

4. Economic Considerations:

Tokenomics: Design and distribution of tokens, incentivizing network participation.

Governance: how blockchain networks are governed, including decision-making processes and dispute resolution mechanisms.

Technical components:

Cryptography

Distributed systems

Consensus mechanisms

Data structures

Smart contracts

Use cases and applications:

Cryptocurrencies

DeFi

Supply chain management

Identity management

Voting systems

NFTs

Economic and game theory aspects:

Tokenomics

Incentive structures

Market dynamics

Major platforms and protocols:

Bitcoin

Ethereum

Other notable blockchains (e.g., Solana, Cardano, Polkadot)

Social and philosophical implications:

Decentralization

Trust and transparency

Privacy concerns

References:

[1] Satoshi Nakamoto (2008) "Bitcoin: A Peer-to-Peer Electronic Cash System".